What do individual ETF investors really want?

Share

The global Exchange Traded Fund (ETF) market keeps growing. In the last decade, ETF assets have more than quadrupled to reach $11.6 trillion by December 20231. As the popularity of these investments show no sign of abating, Amundi took the opportunity to get under the skin of individual or private ETF investors (also known as retail investors) in our recent global retail investor survey. These products have become increasingly appealing to retail investors. Below are four things that you might not know about ETF investors.

ETFs are a key entry point into retail investing

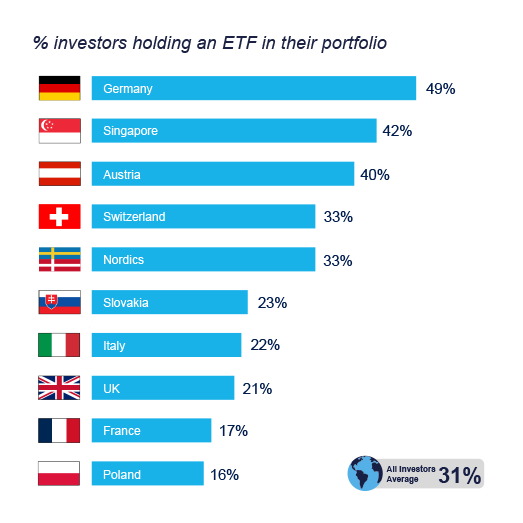

Reflecting the growth in the ETF market over recent years, our survey data below shows that 31% of retail investors globally hold one of these products within their portfolio. This peaks at 49% among those in Germany and 42% among those in Singapore, falling to a more modest 17% in France and 16% in Poland.

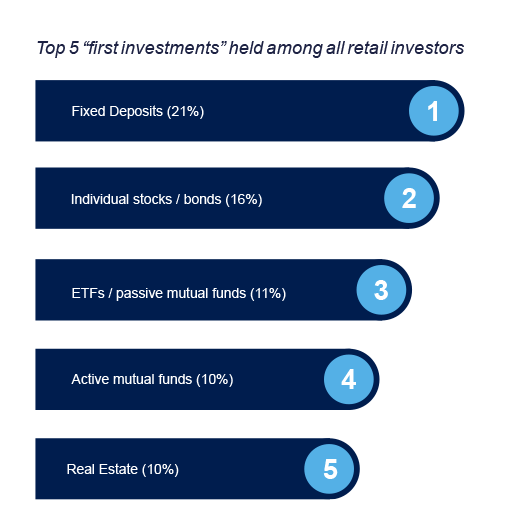

However, our findings also demonstrate that, for many, ETFs act as a crucial first step into the world of investing – cited by more than one-in-ten retail investors globally as the first investment that they ever held.

However, this does not look the same across all markets. Those in the Nordics and Germany are most likely to have chosen an ETF as their first ever investment, while those in France and Poland are significantly less likely.

Source: Amundi: Decoding Digital Investment

ETF investors have a positive outlook

Among those retail investors that hold an ETF, a mean average of 35% of their entire portfolio is currently invested in this type of investment. This is highest among younger investors and those earlier in their accumulation journey, according to the survey. However, there is significant scope for distributors and fund managers to grow this market.

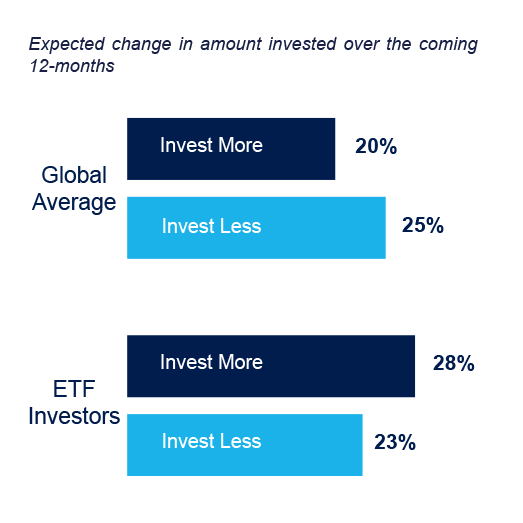

Our findings show that ETF investors hold a more positive market sentiment than the average retail investor – a mindset that can present opportunities for engagement. More than one-in-four ETF investors (28%) expect to increase the amount that they invest over the coming year, compared to only a more modest one-in-five (20%) among all retail investors.

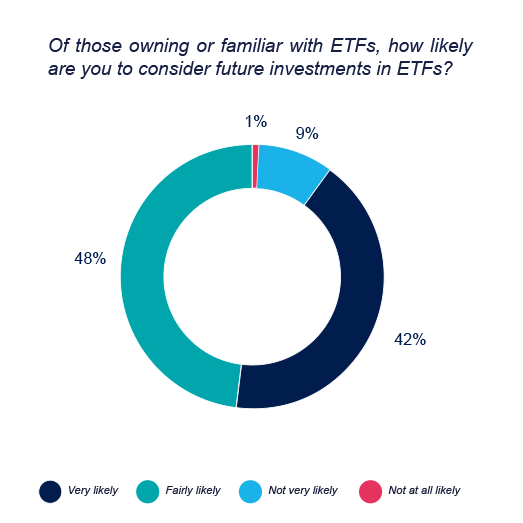

Furthermore, of those already holding or aware of ETFs, the survey shows that nine-in-ten (90%) feel it is either very or fairly likely that they will consider further ETF investments in the future – with our data suggesting that this opportunity is stronger in Germany and among wealthier male investors generally.

Source: Amundi: Decoding Digital Investment

ETF investors are inherently more confident and digitally enabled

One of the key factors that we believe has helped to drive the growth in the ETF market has been the development of digital platforms – making low cost, flexible and comparatively uncomplicated investments far more accessible to confident self-service investors.

Investors who are more confident that they are making the right saving and investment decisions feel more empowered to explore and use digital investment platforms like share trading apps, digital banks, neobanks and self-service investment platforms.

Our findings strongly support this premise – with ETF investors globally both significantly more confident than the average investor that they are making the right saving and investment decisions and being far more likely to hold investments on digital platforms.

Source: Amundi: Decoding Digital Investment

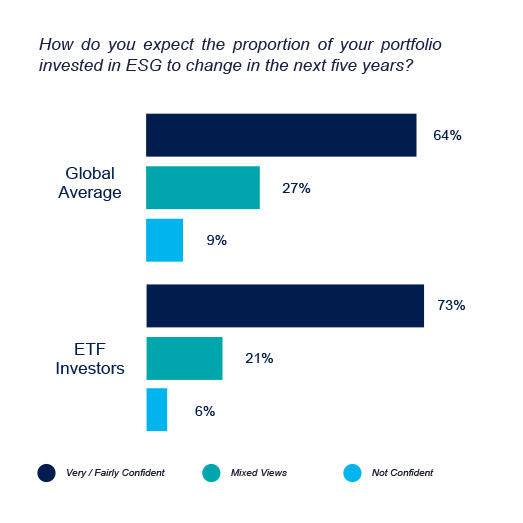

ETF investors are more ESG-focused

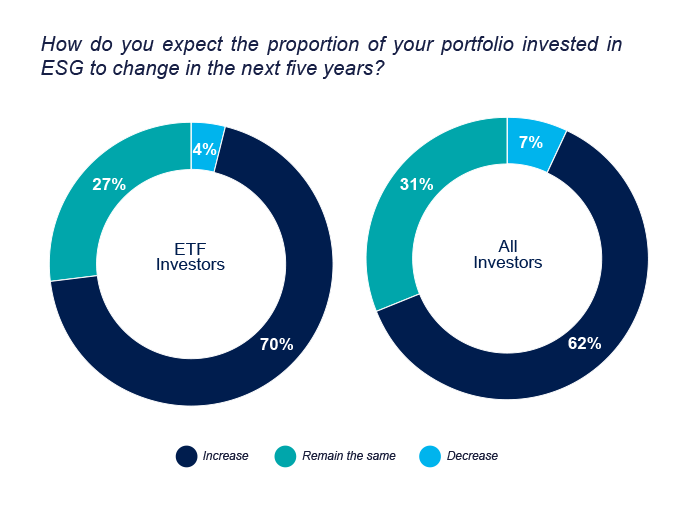

The more positive sentiment and the higher levels of digital engagement among ETF investors looks to have a knock-on effect on their likelihood to invest through an Environmental, Social and Governance (ESG) lens.

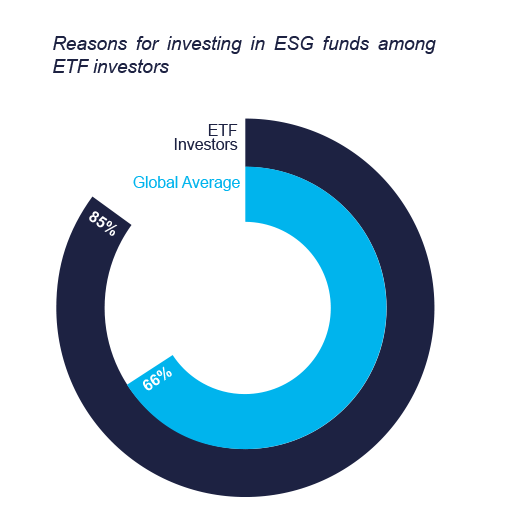

According to our findings in our study, 71% of ETF investors hold ESG investments, either independently seeking them or upon advice. This is significantly higher than the 56% among all investors globally.

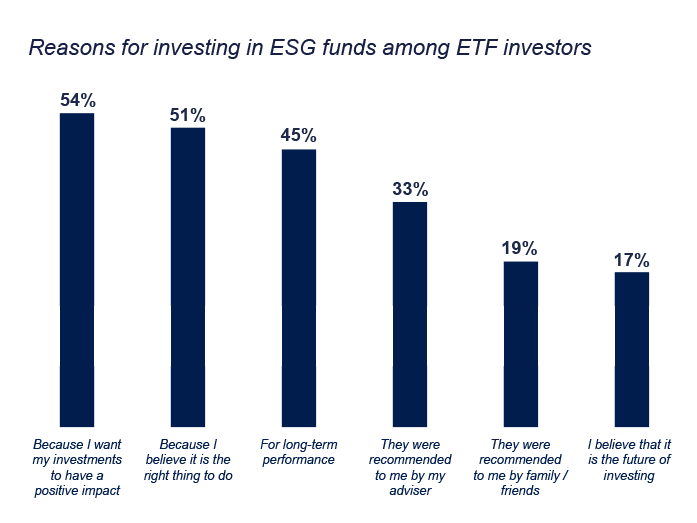

Furthermore, ETF investors are more likely to state that they intend to increase the proportion of their portfolio that is invested through ESG funds (70% vs. 62% overall) – with the key drivers behind this being a desire to have a positive impact (54%) and a belief it is the right thing to do (51%). That said, 45% of ETF investors that own ESG funds also do so in anticipation of better longer-term performance.

Source: Amundi: Decoding Digital Investment

All in all, our survey findings demonstrate that, for distributors, it could make sense to target ETF investors – particularly via digital platforms – given their greater levels of appetite for ETFs, but also a whole wider range of investment types.

* The findings in this article are based on the views of 4,186 retail investors surveyed across 11 countries in Europe and Asia. We set quotas by both age and gender to ensure to have a sufficient and robust sample in order to confidently assess differences between demographic groups. The survey was conducted online, in local language, during May and June 2023.

This research was an independent study undertaken by H/Advisors Cicero.

1. Source: ETFGI ETFs industry in Global industry insights report December 2023

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (‘KID’) or Key Investor Information Document (“KIID”) for UK investors and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com or lyxoretf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

Important information

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The US person definition is indicated in the legal mentions section on www.amundi.com and www.amundietf.com. This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of her subsidiaries. Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID or the KIID for UK investors and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Transaction cost and commissions may occur when trading ETFs. It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects). A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs. This document was not reviewed, stamped or approved by any financial authority. This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them. Potential investors in the UK should be aware that none of the protections afforded by the UK regulatory system will apply to an investment in a Fund and that compensation will not be available under the UK Financial Services Compensation Scheme.

Information reputed exact as of 29 February 2024.

Reproduction prohibited without the written consent of the Management Company.

Amundi ETF designates the ETF business of Amundi Asset Management.

Amundi Asset Management, French “Société par Actions Simplifiée”- SAS with capital of 1 143 615 555 € - Portfolio Management Company approved by the AMF under number GP 04000036 - Registered office: 91, boulevard Pasteur - 75015 Paris – France - 437 574 452 RCS Paris.